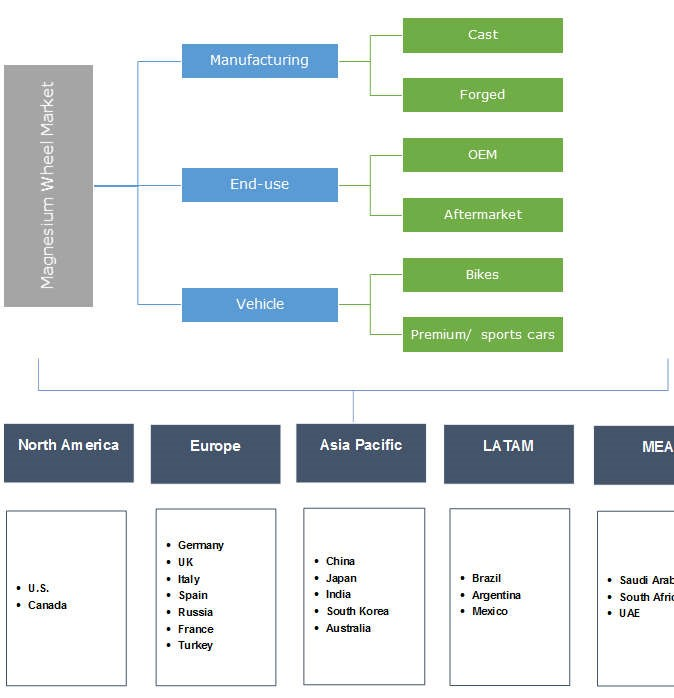

End-Use (OEM, Aftermarket), By

Vehicle (Bikes, Premium/ Sports Cars),

Industry Analysis Report,

Regional Outlook (U.S., Canada, Germany, UK,

Italy, Spain, Russia, France,

Turkey, China, Japan, India, South Korea, Australia, Brazil, Argentina, Mexico,

Saudi Arabia, South Africa, UAE),

Growth Potential, Price Trends,

Competitive Market Share & Forecast,

2017 – 2024

Magnesium

Wheel Market size was worth over USD 22.1 billion

in 2016 and will surpass 76.2 million units by 2024.

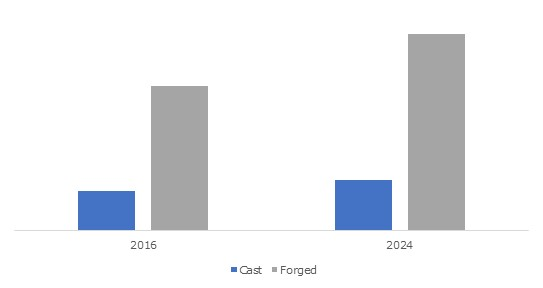

U.S. Magnesium Wheel

Market, By Manufacturing, 2013 – 2024

(Thousand Units)

Shifting trend towards light weight

vehicles along with increased road safety concerns will propel the magnesium

wheel market size. Inclination towards enhanced driving experience accompanied

by increasing replacement of traditional steel by efficient & durable

magnesium material will drive the product demand.

Shifting trend towards light weight

vehicles along with increased road safety concerns will propel the magnesium

wheel market size. Inclination towards enhanced driving experience accompanied

by increasing replacement of traditional steel by efficient & durable

magnesium material will drive the product demand.

Growing automotive industry due to rising

vehicle demand along with increasing consumer spending will support the

industry growth. As per analysis, in

2016 U.S. passenger car sales reached 6 million, while only 4 million cars were

manufactured in the country. Changing automotive trends including vehicle

customization, improved fuel efficiency and reduced weight are the key factors

positively influencing the product penetration.

Increasing preference for green mobility

coupled with stringent regulations promoting lightweight automotive components

has enhanced the industry demand. According to California Vehicle Code (CVC),

gross weight on any wheel should not surpass 10,500 pounds. For every 100

pounds of vehicle weight reduction, there is an average decrease of about 2%

fuel consumption. Rising demand for hybrid and electric vehicles will drive the

industry growth, as weight reduction is major concern in hybrid automobiles.

Increasing R&D spending along with

technological innovations are the driving factors for business growth. Rising

product demand from premium compact vehicles, sports cars and premium motorcycles

will propel the magnesium wheel market. Weight reduction, enhanced vehicle

braking system and improved acceleration are the significant benefits fueling

the industry demand.

Economic instability, stagnant industry

growth and fluctuating raw material costs are the key factors affecting

magnesium wheel price trend. However, excessive costs associated with initial

set up and repair may hamper the industry growth.

Cast manufacturing was valued over USD 5.6

billion in 2016. Low production cost and easier manufacturing process are the

supporting factors of industry demand. However, comparatively heavier weight

along with manufacturing defects including pores, cavities and metallurgical

microstructure causing large grain size may restrain the segment growth.

Forged manufacturing accounted for over

71% of the overall industry share in 2016. High durability, lightweight,

rigidity, strength and easy repairing are the key properties driving the

industry growth. Forged magnesium wheel are around 1.5 times lighter compared

to aluminum and 2.2 times lighter relative to steel. Moreover, absence of

casting defects including cracks and bends provides a positive outlook for product

demand.

OEM market generated over 39.8 million

units and is anticipated to exhibit major industry share by 2024. Shifting

manufacturer preference for vehicle weight reduction is the key driving factor

for magnesium wheel market growth. Product innovations and development coupled

with heavy R&D investment by OEMs will propel industry demand.

Magnesium wheel aftermarket will witness

CAGR over 4.5% from 2017 to 2024. Increasing product replacement frequency

particularly for passenger cars will support the industry growth. Shifting

trend for vehicle customization and lightweight automotive components have

enhanced the product demand. Rise in rate of vehicle accidents due to poor road

conditions and lack of stringent regulations in several countries will drive

the business growth. Moreover, favorable insurance schemes will support the

product demand.

Bikes market was worth over USD 520

million in 2016. Increasing road congestion due to rising population is the key

factor fueling the industry growth. Changing income trends along with

increasing preference for motorbikes has enhanced the product demand. Superior

product properties including lower overheating, high strength and relatively

light weight will propel the magnesium wheel market from bikes.

Premium/ sports cars will value over USD

27.8 billion by 2024. Rising demand for premium & luxury vehicles

particularly in North America and Western Europe will drive the industry

growth. Necessity for superior quality products to enhance acceleration and

quick braking are the key factors supporting product demand.

Europe accounted for over 40% of the

magnesium wheel market share in 2016. Recovery of automobile sector along with

increasing penetration of premium cars particularly in UK, Germany, Italy,

Spain and Poland will drive the regional demand. Presence of premium automotive

manufacturers including Lamborghini, Ferrari, Audi, BMW and Porsche provides a

positive outlook for industry growth.

Asia Pacific magnesium wheel market

revenue is anticipated to surpass USD 8.2 billion by 2024. Growing automotive

production due to favorable socio-economic conditions for manufacturing

facilities will propel the industry growth. Increasing penetration of premium

& luxury vehicles particularly in Japan and China will drive the product

scope. Moreover, initiatives by Japanese associations to improve product

quality will further support the industry demand.

North America will witness gains over 3.5%

up to 2024. Stringent emission norms coupled with government initiatives

promoting lightweight vehicles will drive the demand. High disposable income

and improved standard of living are the key factors enhancing premium vehicle

demand.

BBS, Enkei, MKW Alloy, SMW Engineering and

O.Z. Group are among the prominent players in magnesium wheel market share.

Industry players mainly focus on collaborations with high end premium car

manufacturers to increase customer base and strengthen foothold. For instance,

O.Z. Group partnered with leading OEMs including Ferrari, Volkswagen, Mercedes

Benz, etc. In August 2016, the company renewed its partnership with Ferrari

till 2019.

Product positioning for sport and premium

car manufacturers is the major strategy observed. For instance, BBS have

focused its supply for sports cars used in Formula One. Similarly, Enkei

Corporation developed products suitable for sportscars adopting the stringent

JGTC regulations. Moreover, technological advancement and heavy R&D

investment are among other strategies adopted. For instance, in 2016, SMW

Engineering launched research & development projects to perform in depth

analysis of environmental & economic benefits of magnesium wheel.

|

Stringent regulations for emission

reduction and usage of light weight vehicles has been a major driver for

industry growth. For instance, EC has set target of automobile emissions

reduction to reach 175g CO2/km by 2017 and 147 g CO2/km by 2020 for lightweight

vehicles. JAWA aims at improving quality of light alloy materials promoting

product penetration in automotive aftermarket.